- The VA Funding Fee is a governmental fee required for many VA borrowers.

- Some Veterans are exempt from this fee if they have a service-related disability.

- The funding fee amount varies based on your loan type, prior VA loan usage and if you include a down payment.

VA loans offer eligible Veterans and military spouses unique benefits to help them achieve homeownership. From $0 down and no PMI to consistently lower than average interest rates, the VA loan is often one of the best choices on the market today.

To keep this program running for future generations of Veteran homebuyers, the Department of Veterans Affairs requires most borrowers to pay the VA Funding Fee.

What is the VA Funding Fee?

The VA Funding Fee is a one-time fee paid to the Department of Veterans Affairs. While most Veterans pay 2.15%, this fee ranges from 0.5% to 3.3%, depending on the loan type, whether you've used a VA loan before or have a down payment greater than 5%.

Want to determine your funding fee? Use this simple VA Funding Fee calculator to get an instant estimate.

While the VA requires most borrowers to pay the funding fee, not every borrower must do so. A handful of exemptions exist, including borrowers who receive compensation for service-connected disabilities.

View the complete list of exemptions here.

Determining the Funding Fee Amount

Calculating your VA Funding Fee amount can be tricky since it’s not a flat rate and depends on several factors. Here’s what affects how much you’ll pay:

- Loan type: The fee changes based on whether you buy a home, refinance through the VA IRRRL program or take out a cash-out refinance.

- First-time vs. repeat use: First-time VA loan users typically pay a lower fee, while the fee may increase for those using the benefit again without a down payment.

- Down payment amount: VA loans don’t require a down payment, but putting down at least 5% can significantly reduce your funding fee.

- Exemption status: Veterans who receive VA disability compensation and certain others do not have to pay the funding fee.

Historically, regular military members pay slightly lower funding fees than Reservists and National Guard members. However, fees for all military branches are now equal due to the passing of the Blue Water Navy Vietnam Veterans Act of 2019.

What is the Funding Fee for a Veterans United Loan?

The funding fee for a Veterans United VA loan is determined by the U.S. Department of Veterans Affairs, not Veterans United. While most Veterans typically pay 2.15%, this fee can range from 0.5% to 3.3%.

VA Funding Fee for Purchase Loans

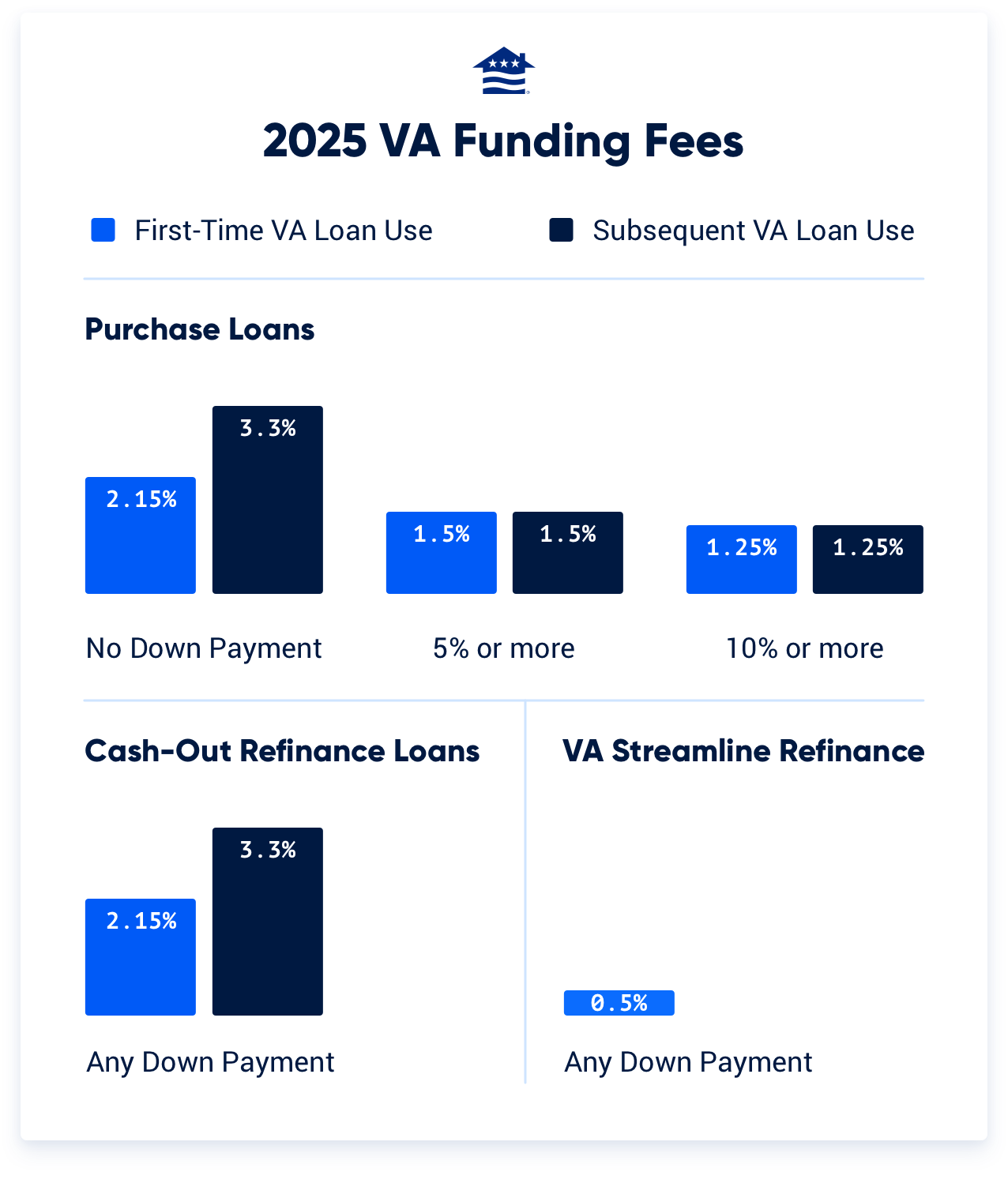

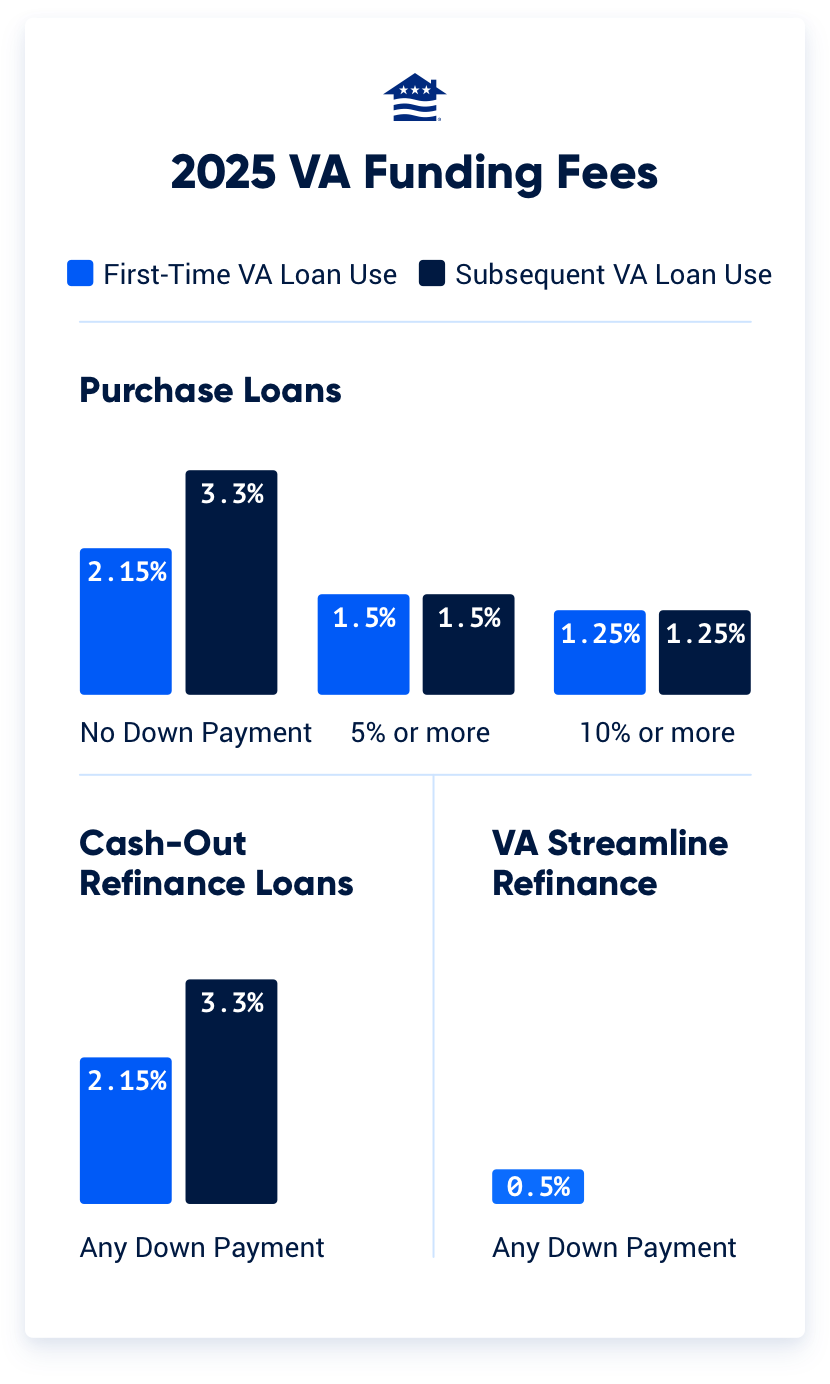

As you'll see below, Veterans purchasing with a VA loan for the first time receive a lower fee than subsequent users. Though not required, first-time and subsequent purchasers can decrease the funding fee with a minimum 5% down payment.

The following table shows the current VA Funding Fee rates on purchase loans for Veterans, active military, Reservists and National Guard members.

2025 VA Funding Fee Chart

| Down Payment | First-Time VA Loan Use | Subsequent VA Loan Use |

|---|---|---|

| No Down Payment | 2.15% | 3.3% |

| 5% or more | 1.5% | 1.5% |

| 10% or more | 1.25% | 1.25% |

VA Funding Fee for Refinance Loans

The VA has two refinance products: The Interest Rate Reduction Refinance Loan (IRRRL) and the VA Cash-Out refinance. The funding fees for each type of VA refinance differ partly because of their objectives.

The IRRRL exists to get current VA homeowners into a lower mortgage rate or move from an adjustable rate to a fixed-rate VA loan. The VA Cash-Out refinance allows qualified Veterans to refinance and extract cash from home equity, and it's open to eligible Veterans with VA and non-VA loans.

The funding fee for a cash-out refinance is similar to a VA purchase loan, except borrowers cannot lower the VA Funding Fee by making a down payment or using equity.

The following table shows the VA Funding Fee rates on VA Cash-Out refinance loans for Veterans, active military, Reserves and National Guard members.

2025 VA Funding Fee Chart for Cash-Out Refinance Loans

| First Use | After First Use |

|---|---|

| 2.15% | 3.30% |

What is the VA Funding Fee for the VA IRRRL?

Unless otherwise exempt, the VA Funding Fee for borrowers using the VA Streamline refinance (IRRRL) is 0.5% regardless of service history or prior usage.

VA Funding Fee Exemptions

Not everyone is required to pay the VA Funding Fee. In fact, some Veterans may have the fee waived entirely. The VA exempts specific borrowers from paying the funding fee on both purchase and refinance loans.

Those exempt from paying the VA Funding Fee include:

- Veterans who receive compensation for service-connected disabilities

- Veterans who would receive disability compensation if they didn't receive retirement pay

- Veterans rated as eligible to receive compensation based on a pre-discharge exam or review

- Veterans who can but are not receiving compensation because they're on active duty

- Purple Heart recipients

- Surviving spouses who are eligible for a VA loan

When evaluating funding fee exemptions, lenders typically look at the Certificate of Eligibility or a Verification of VA Benefits (sometimes referred to as the VA Funding Fee exemption form).

For Veterans who receive retirement pay instead of VA compensation, lenders can use a copy of the original disability rating notification and financial documents that show the retirement income.

There are situations where the exemption status isn't clear-cut. Only the VA can determine funding fee exemptions.

Lenders must collect the funding fee and send it to the VA when they can’t confirm a borrower’s exemption status before closing or when the borrower has a pending disability claim at the time of closing.

The Veteran may receive a refund of the VA Funding Fee if the VA grants disability compensation after the loan closes.

Paying the VA Funding Fee

Mortgage lenders have no control over who must pay the VA Funding Fee or the specific amount. Your Certificate of Eligibility (COE) typically indicates if you must pay the VA Funding Fee.

Your lender is responsible for collecting and sending the funding fee directly to the VA through their automated system.

How Do I Pay the VA Funding Fee?

VA buyers can pay the VA Funding Fee in one of the following ways:

- Finance the fee over the life of the loan

- Pay the full fee out of pocket at closing

- Ask the seller to pay the fee on their behalf

Typically those required to pay the VA Funding Fee choose to finance it into the entire loan amount.

For reference, on a typical $200,000 loan, a regular military Veteran using a VA loan for the first time would borrow an additional $4,300 to cover the funding fee.

Uncommon Funding Fee Scenarios

When two Veterans with VA loan entitlement get a loan together, the funding fee is still in play. But it can work differently in these relatively uncommon cases. A primary consideration is who is contributing to the VA loan entitlement.

If two Veterans use their entitlement and one qualifies for a funding fee exemption, the VA reduces the total funding fee amount on the loan by half. If the same set of Veterans seek a VA loan, but the exempt Veteran is not contributing entitlement, their loan would carry the full funding fee.

Lastly, VA loan assumptions come with a 0.5% funding fee.

If you have questions about VA loan closing costs, including the funding fee, talk with a Veterans United VA loan expert at 855-870-8845 or get started online today.

How We Maintain Content Accuracy

Our mortgage experts continuously track industry trends, regulatory changes, and market conditions to keep our information accurate and relevant. We update our articles whenever new insights or updates become available to help you make informed homebuying and selling decisions.

Current Version

Apr 16, 2025

Written ByChris Birk

Reviewed ByDon Wilson

Minor updates to content to improve readability and clarity.

Dec 31, 2024

Written ByChris Birk

Reviewed ByDon Wilson

Updated the year from 2024 to 2025 and verified the accuracy of VA funding fee numbers.

Dec 10, 2024

Written ByChris Birk

Reviewed ByDon Wilson

Content fact checked and reviewed by underwriter Don Wilson.

Veterans United often cites authoritative third-party sources to provide context, verify claims, and ensure accuracy in our content. Our commitment to delivering clear, factual, and unbiased information guides every piece we publish. Learn more about our editorial standards and how we work to serve Veterans and military families with trust and transparency.

Related Posts

-

VA Renovation Loans for Home ImprovementVA rehab and renovation loans are the VA's answer to an aging housing market in the United States. Here we dive into this unique loan type and the potential downsides accompanying them.

VA Renovation Loans for Home ImprovementVA rehab and renovation loans are the VA's answer to an aging housing market in the United States. Here we dive into this unique loan type and the potential downsides accompanying them. -

Pros and Cons of VA LoansAs with any mortgage option, VA loans have pros and cons that you should be aware of before making a final decision. So let's take a closer look.

Pros and Cons of VA LoansAs with any mortgage option, VA loans have pros and cons that you should be aware of before making a final decision. So let's take a closer look.