- A statement of service verifies active-duty military status and is required by lenders to confirm eligibility for a VA loan.

- The document must include up-to-date service details and be signed on official letterhead, typically dated within 30 days of application to avoid delays.

When applying for a VA loan, active-duty service members are typically required to submit a statement of service. This document helps lenders confirm your VA loan eligibility and move your loan application forward.

If you’re currently serving in the military, understanding what this document includes and how to get it can help you avoid delays when using your VA loan benefit.

What is a VA Loan Statement of Service?

A statement of service for VA loans is a formal letter that provides concrete evidence of your military service, which is especially important when qualifying for a VA mortgage.

Lenders typically use this letter to confirm your employment history and eligibility for a VA loan. For example, if you’re an active-duty Air Force member and applying for your first VA loan, the lender will request a statement of service to confirm you're currently serving, your rank, your date of entry and any service obligation end dates.

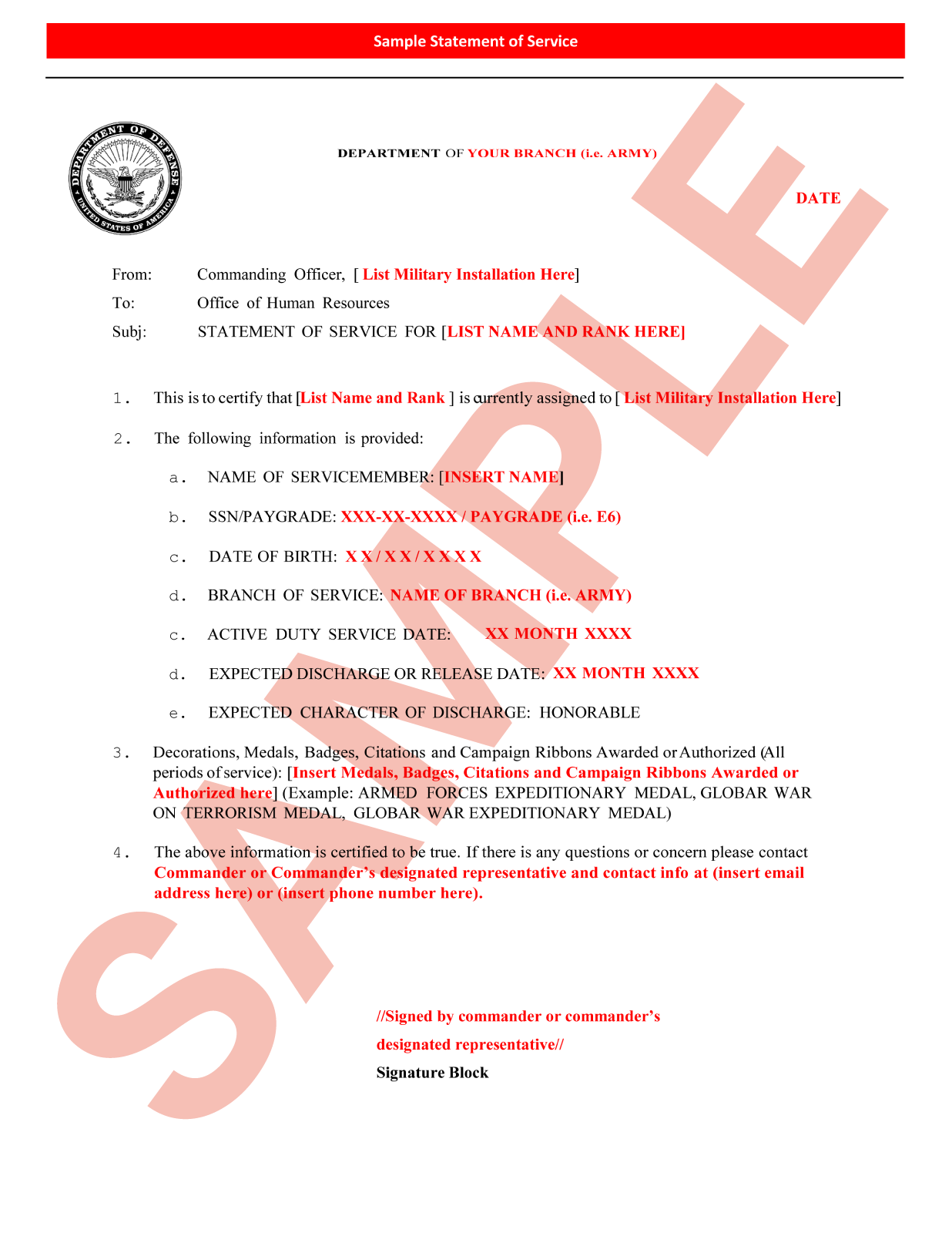

Statement of Service Example

Keep in mind that the format of your statement of service may vary based on your commanding officer. Here's a general template to give you an idea of what it might look like:

Example statement of service document courtesy of U.S. Customs and Border Protection.

VA Loan Statement of Service Requirements

A statement of service is usually mandatory for active-duty service members when getting a VA loan. While the exact format may vary, the letter typically includes information that your VA lender needs to verify your military employment.

Some of the key information commonly found in a statement of service includes:

- Official letterhead

- Date

- Full name

- Social security number

- Date of birth

- Branch of service

- Rank

- Date entered on active duty

- Current date of separation

- Unit of assignment and current duty location

- Duration of time lost (if any)

- Last discharge

- Type of discharge

- Barred or flagged status from continued service

- Reservist status (active or inactive)

- Eligibility to reenlist

- Information current as of date

- Signature and title of signer

Statement of Service vs. Leave and Earnings Statement

Active-duty service members are often required to submit both a Statement of Service and a Leave and Earnings Statement (LES) when applying for a VA loan. But these documents serve very different purposes.

Your LES primarily focuses on your income information. It outlines your base pay, allowances, deductions, and other financial details that help the lender verify your ability to repay the loan.

On the other hand, the statement of service confirms your current military status and covers a broader range of information that underwriters consider.

How to Get a Statement of Service for a VA Loan

Securing your statement of service for a VA home loan can be a time-consuming process, so you should start the process as early as possible. Your commanding officer is typically the key source for obtaining this document. When reaching out to request your statement of service, be sure to specify all the required details to ensure the letter is accurate and comprehensive.

Generally, the process for obtaining a statement of service looks like:

- Let your admin office know you need the document for a VA home loan

- Draft or download a template for an official statement of service (some branches have preferred formats, such as Form DA 1506 for the Army)

- Send your personal information, statement draft and commanding officer contact info to one of the following:

- Army: S-1 or Soldier Readiness Section

- Air Force: Military Personnel Flight

- Navy: Admin Officer, Executive Officer or Yeoman staff

- Marines: S-1 or battalion admin

- Have the letter signed and dated by your commanding officer

- Submit the statement of service to your VA lender

Depending on your service, some VA lenders may request Form DD-214, your LES or points statement alongside the statement of service.

Most lenders require your statement of service to be dated within 30 days of your loan application. It is also best practice to submit the document electronically when possible to protect sensitive information and streamline the process.

Common Statement of Service Pitfalls

To keep your VA loan on track, it’s important to avoid a few common mistakes when submitting your statement of service. One of the biggest missteps is requesting the document too early. Since lenders usually require it to be dated within 30 days of your application, an outdated statement could delay your approval or require a fresh copy.

Another common issue is missing or incomplete information. Even small omissions like leaving out your rank, service dates or submitting a version without a valid signature can slow things down.

Your statement of service must reflect current, up-to-date and complete information to satisfy VA lending guidelines.

Using official unit letterhead, including all required details and ensuring the document is properly signed are key to avoiding unnecessary setbacks.

If you need help with your statement of service, reach out to a Veterans United VA loan expert at 855-870-8845 or get started online today.

How We Maintain Content Accuracy

Our mortgage experts continuously track industry trends, regulatory changes, and market conditions to keep our information accurate and relevant. We update our articles whenever new insights or updates become available to help you make informed homebuying and selling decisions.

Current Version

Nov 20, 2025

Written BySamantha Reeves

Reviewed ByDon Wilson

Updated statement of service example image and added information about common issues. Article fact checked by underwriter Don Wilson.

Related Posts

-

What is the VA Seller Concession Rule?Seller concessions with a VA home loan can save Veteran homebuyers thousands of dollars, but cannot exceed 4% of the loan.

What is the VA Seller Concession Rule?Seller concessions with a VA home loan can save Veteran homebuyers thousands of dollars, but cannot exceed 4% of the loan. -

VA Loan Discount PointsPurchasing discount points on a VA loan can be a good investment for Veterans looking to lower their interest rate.

VA Loan Discount PointsPurchasing discount points on a VA loan can be a good investment for Veterans looking to lower their interest rate.